1

Please refer to important disclosures at the end of this report

1

1

K.P.R. Agrochem Limited (K.P.R) is an agri-input Company focused on

manufacturing, distribution and retailing of a wide range of crop yield enhancing

and protection products. It has 3 manufacturing facilities. Fertilizers segment

contributes around 60% of revenue, pesticides around 25% of revenue followed

by chemicals & seeds contributing 10% & 5% of revenue respectively.

Positives: (1) Company has ideal capacity in all the plants, so no major capex is

required. 2) Experience Promoters & management team. 3) Strong & growing

distribution network. 4) Wide variety of product portfolio. 4) Company sales is

almost concentrated in south, there is scope for geographical expansion. 5) Due

to amount raised through IPO, company working capital will increase which will

help increase production leading to higher sales.

Investment concerns: (1) From last few years sales as well as profits are stagnant.

2) Company, Promoters & Directors are involved in legal proceedings. Legal

proceedings relate to dishonor of cheques, Fertilizers Control Order, 1985. 3)

Promoters & Directors of the company have equity interest in group entities &

there is no restriction on group entities to do business similar to K.P.R. 4) Group

entities have defaulted on payment of loans. 5) Company business is highly

dependent on rainfall in southern part of India.

Outlook & Valuation: At the upper end of the price band, K.P.R. demands PE

multiple of 17.6x of FY18 EPS. Coromandel International too trades at same PE

multiple compare with K.P.R. which is growing at faster rate compare to K.P.R.

Deepak Fertilizers & Petrochemicals and Chambal Fertilizer trades at PE multiple

6.5x & 14.4x of FY18EPS respectively. Considering all these, we have a NEUTRAL

view.

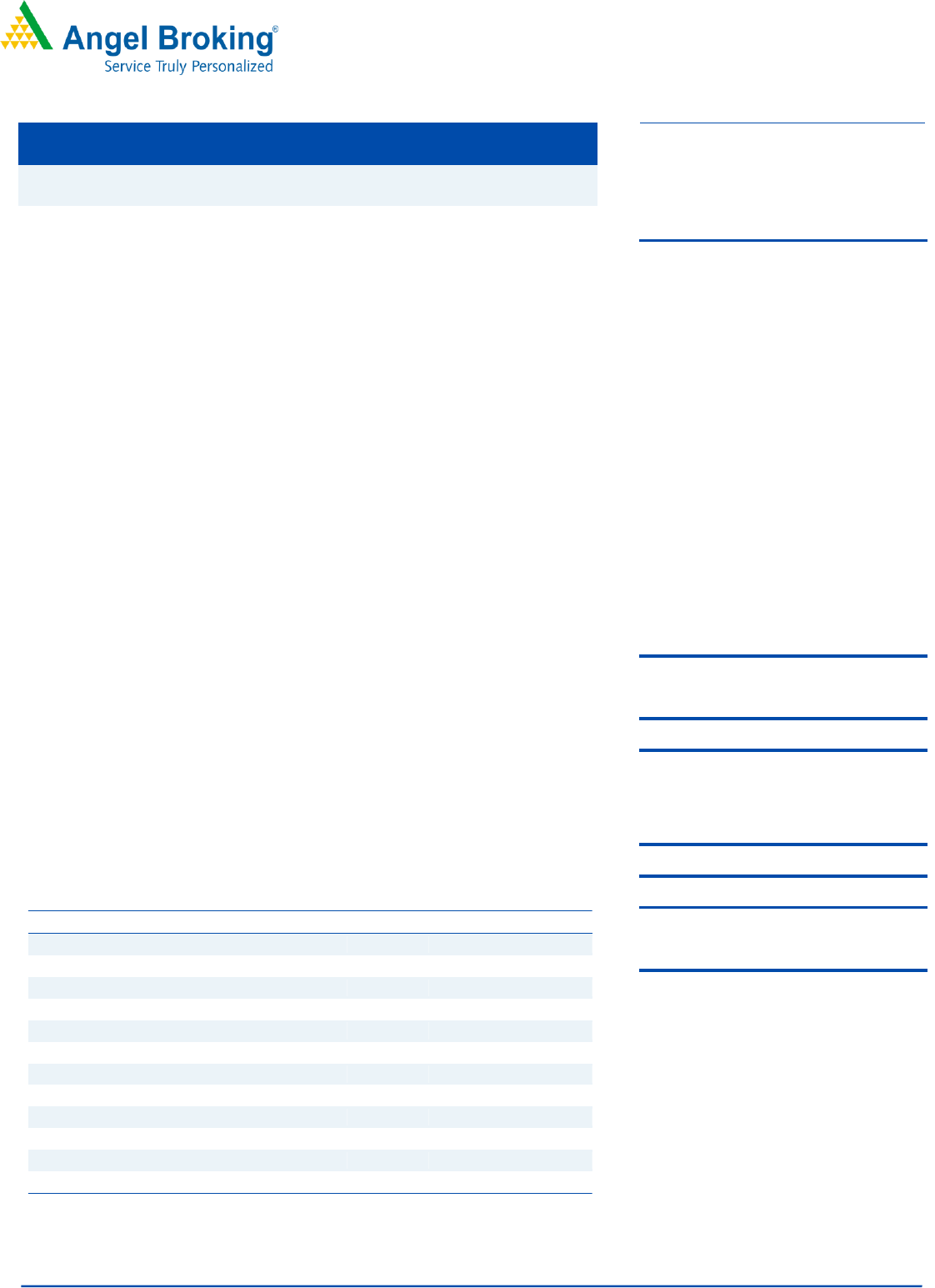

Key Financials

Y/E March (` cr)

FY16

FY17

FY18

FY19E

Net Sales

580.1

583.7

599.8

603.2

% chg

-

0.6

2.8

0.6

Net Profit

24.3

22.7

29.7

32.1

% chg

-

-6.4

30.4

8.1

EBITDA (%)

103.4

95.5

104.3

106.5

EPS (Rs)

2.8

2.7

3.5

3.8

P/E (x)

21.5

22.9

17.6

16.3

P/BV (x)

3.0

2.7

2.3

2.0

RoE (%)

14.1

11.7

13.2

12.5

RoCE (%)

15.9

14.0

14.1

15.3

EV/EBITDA

8.4

8.9

8.4

7.6

EV/Sales

1.5

1.5

1.5

1.3

Company Source: RHP, Angel Research; Note: Valuation ratios based at upper end of the price

band.

NEUTRAL

Issue Open: June 28, 2019

Issue Close: July 02, 2019

QIBs 25% of issue

Non-Institutional 35% of issue

Retail 40% of issue

Promoters

48%

Others

52%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `119.8cr

Issue size (amt): *`281.8 -**`283.2 cr

Price Band: `59-61

Lot Size: 200 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`785cr -

**`804.5cr

Promoters holding Pre-Issue: 72%

Promoters holding Post-Issue: 48%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `210 cr

Face Value: `10

Present Eq. Paid up Capital: `85.46cr

Offer for Sale: **1.2 cr Shares

K.P.R. AGROCHEM LIMITED

IPO Note | Agro Chem

Jun 27, 2019

2

Jun

27,

201

K.P.R. Agrochem Limited | IPO Note

Jun 27, 2019

2

Company background

K.P.R. Agrochem Limited (K.P.R) was incorporated on January 02, 2007.

Promoters of the Company are Papa Reddy, Venkata Mukunda Reddy,

Rajasekhar Reddy, Satyanarayana Reddy (S/O. Ramachandra Reddy),

Satyanarayana Reddy (S/O. Veera Raghava Reddy) & Cresco Technology LLP.

K.P.R. is an agri-input Company focused on manufacturing, distribution and

retailing of a wide range of crop yield enhancing and protection products.

Comapny product portfolio includes crop protection, crop nutrients, seeds,

veterinary feed supplements. Further, in order to secure supply of sulphuric

acid, one of the key ingredients, K.P.R. also ventured into manufacturing of

sulphuric acid. Comapny produce sulphuric acid as well as other sulphuric

acid based chemicals like LABSA and oleum that have wider applications

across industries like agrochemicals, veterinary feed supplements,

pharmaceuticals, synthetic detergents etc

Company operates three manufacturing facilities viz one each at

Balabhadrapuram and Biccavolu in Andhra Pradesh and one in Koppal

district, Karnataka and their seed processing unit is located in Warangal

district. The Company has depots at 11 locations, C&F agents in 4 locations,

8000 dealers, 126 Kisan seva Kendras. The company also has registration of

156 formulations.

Issue Details

K.P.R is raising `210cr through fresh issue & selling 1.2cr equity shares

through offer for sale in the price band of `59-61. Retail & eligible employees

are also eligible for `3 discount.

Rajasekhar Reddy is the Whole Time Director & Executive Director of the

Company. He has experience of over a decade in business of chemical,

agrochemical. He holds Bachelor’s degree in Computer Science from

University of Madras.

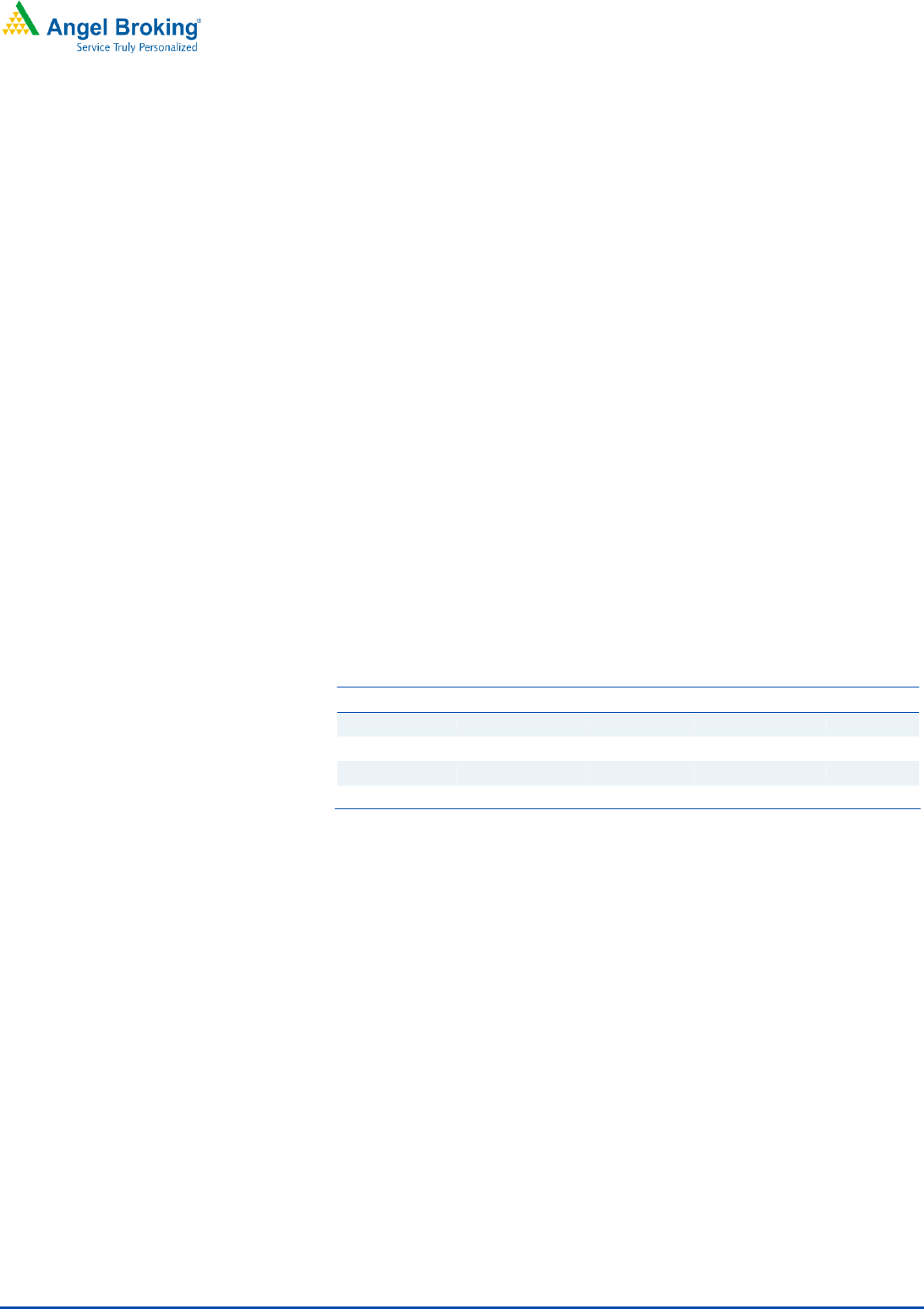

Exhibit 1: Exhibit 1: Pre & Post IPO Shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

61,547,480

72

49,547,480

48%

Public

23,916,520

28

70,342,750

52%

85,464,000

100

119,890,230

100

Source: RHP, Angel Research. Note: Calculated on upper price band.

Objects of the offer

Repayment of debt (`30cr), working capital requirements (`150cr) and

balance for general corporate purposes.

Key Management Personnel:

Papa Reddy, aged 82 years is the chairman & Whole Time Director of the

Company. He has experience of over four decades in the agriculture business.

Venkata Reddy is the Managing Director of the Company. He has experience

of over two decades in the business of agrochemical industry. He holds

Bachelor’s degree in Arts from Andhra University.

3

Jun

27,

201

K.P.R. Agrochem Limited | IPO Note

Jun 27, 2019

3

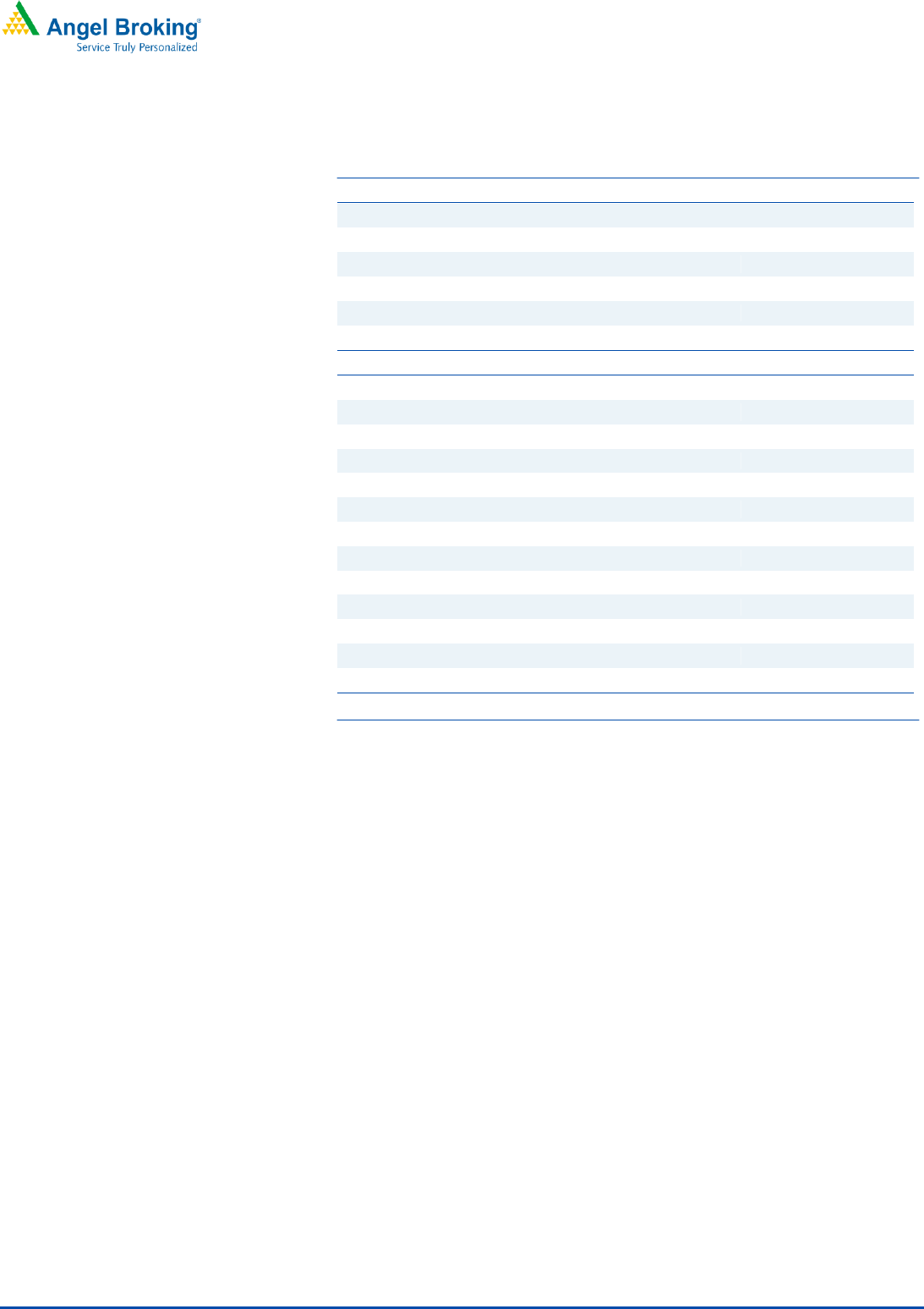

Consolidated Balance Sheet

Y/E March (` cr)

FY16

FY17

FY18

FY19E

SOURCES OF FUNDS

Equity Share Capital

85.5

85.5

85.5

85.5

Reserves& Surplus

86.9

109.7

139.3

171.4

Shareholders Funds

172.4

195.1

224.8

256.9

Total Loans

367.3

345.7

366.5

306.5

Other liability & provision

50.8

43.6

51.7

59.5

Total Liabilities

590.5

584.5

643.0

622.9

APPLICATION OF FUNDS

Net Block

247.1

246.2

231.5

216.4

Capital Work-in-Progress

0.4

0.1

-

-

Investments

10.5

10.5

-

-

Current Assets

509.4

566.3

556.2

535.4

Inventories

263.4

323.8

292.8

274.9

Sundry Debtors

198.9

216.5

235.6

231.4

Cash

18.8

16.0

14.6

13.6

Loans & Advances

25.6

7.8

10.6

12.0

Other Assets

2.7

2.3

2.5

3.5

Current liabilities

222.5

288.9

197.7

181.9

Net Current Assets

286.9

277.4

358.5

353.5

Other Non Current Asset

45.5

50.2

53.1

53.0

Total Assets

590.5

584.5

643.0

622.9

Source: Company, Angel Research

4

Jun

27,

201

K.P.R. Agrochem Limited | IPO Note

Jun 27, 2019

4

Exhibit 2: Consolidated Income Statement

Y/E March (` cr)

FY16

FY17

FY18

FY19E

Total operating income

580.1

583.7

599.8

603.2

% chg

-

0.6

2.8

0.6

Total Expenditure

476.7

488.2

495.5

496.7

Raw Material

388.6

402.0

415.7

418.1

Personnel

29.0

33.7

32.2

31.2

Others Expenses

59.0

52.5

47.6

47.4

EBITDA

103.4

95.5

104.3

106.5

% chg

-

-7.6

9.2

2.1

(% of Net Sales)

17.8

16.4

17.4

17.7

Depreciation& Amortisation

17.5

19.9

20.8

20.1

EBIT

85.8

75.6

83.5

86.4

% chg

-

-11.9

10.4

3.4

(% of Net Sales)

14.8

13.0

13.9

14.3

Interest & other Charges

50.9

55.0

46.7

45.9

Other Income

1.3

7.0

1.0

1.0

(% of Sales)

0.2

1.2

0.2

0.2

Recurring PBT

36.3

27.6

37.8

41.4

% chg

-

-23.9

37.1

9.5

Tax

12.0

4.9

8.2

9.4

PAT (reported)

24.3

22.7

29.7

32.1

% chg

-

-6.4

30.4

8.1

(% of Net Sales)

4.2

3.9

4.9

5.3

Basic & Fully Diluted EPS (Rs)

2.8

2.7

3.5

3.8

% chg

-

-6.3

30.5

8.1

Source: Company, Angel Research

5

Jun

27,

201

K.P.R. Agrochem Limited | IPO Note

Jun 27, 2019

5

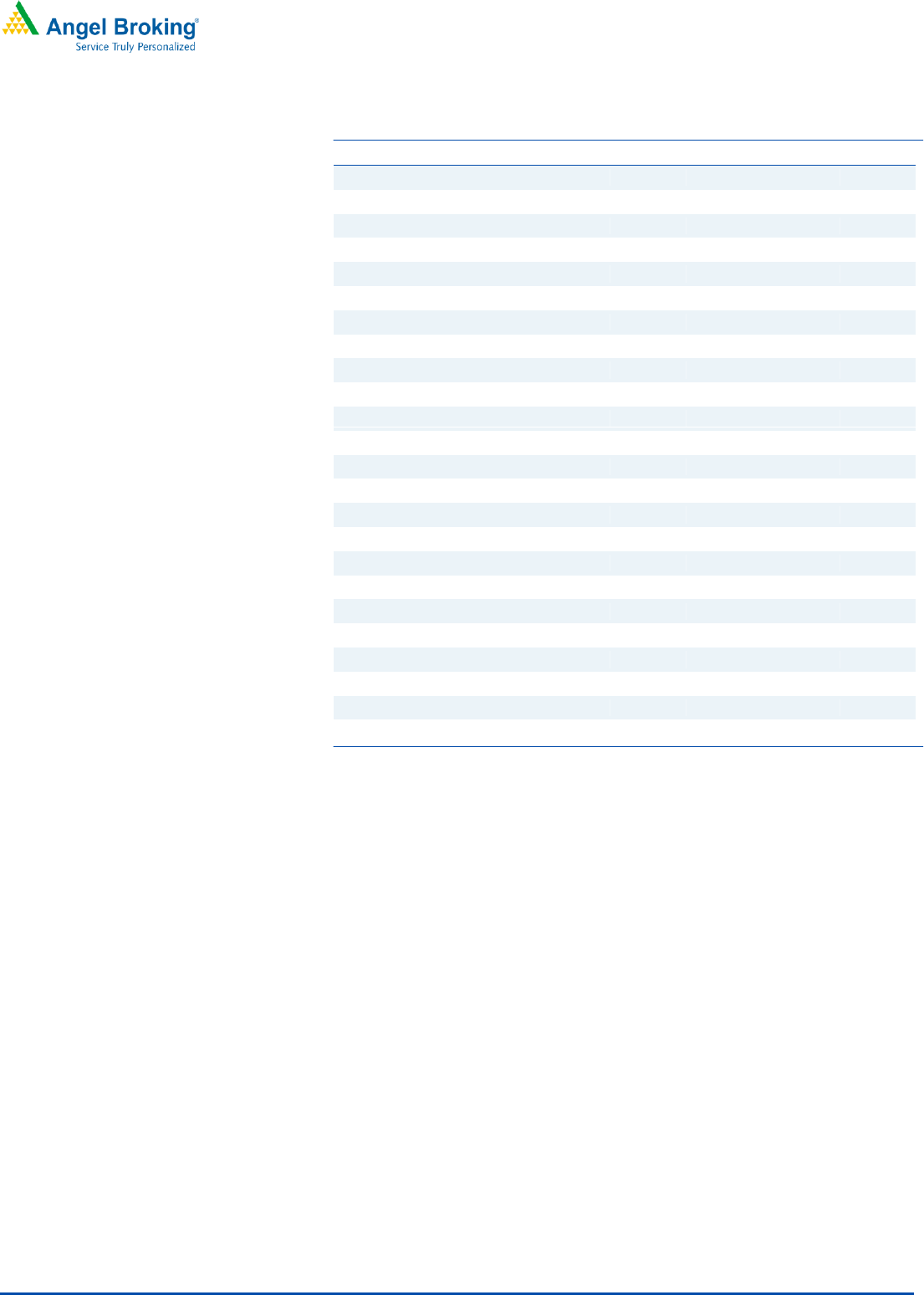

Consolidated Cash Flow Statement

Y/E March (`cr)

FY16

FY17

FY18

FY19E

Profit before tax

36.3

27.6

37.8

41.4

Depreciation

17.5

19.9

20.8

20.1

Change in Working Capital

24.2

(22.6)

(70.4)

4.2

Interest

49.7

54.3

45.8

45.9

Direct taxes paid

(10.2)

(2.6)

(7.5)

(9.4)

Others

0.3

0.4

3.9

-

Cash Flow from Operations

117.8

76.9

30.4

102.3

(Inc.)/ Dec. in Fixed Assets

(40.7)

(18.8)

(6.0)

(5.0)

(Inc.)/ Dec. in Investments

-

-

10.5

-

Interest Income

1.1

0.5

0.7

-

Cash Flow from Investing

(39.6)

(18.3)

5.2

(5.0)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

(22.1)

(2.7)

9.2

(52.4)

Interest Paid

(50.6)

(53.5)

(46.0)

(45.9)

Dividend Paid

(5.1)

(5.1)

-

-

Cash Flow from Financing

(77.9)

(61.4)

(36.9)

(98.4)

Inc./(Dec.) in Cash

0.3

(2.8)

(1.4)

(1.0)

Opening Cash balances

18.5

18.8

16.0

14.6

Closing Cash balances

18.8

16.0

14.6

13.6

Source: Company, Angel Research

6

Jun

27,

201

K.P.R. Agrochem Limited | IPO Note

Jun 27, 2019

6

Key Ratios

Y/E March

FY16

FY17

FY18

FY19E

Valuation Ratio (x)

P/E (on FDEPS)

21.5

22.9

17.6

16.3

P/CEPS

11.8

12.5

9.6

10.0

P/BV

3.0

2.7

2.3

2.0

Dividend yield (%)

-

-

-

-

EV/Sales

1.5

1.5

1.5

1.3

EV/EBITDA

8.4

8.9

8.4

7.6

EV / Total Assets

1.1

1.0

1.0

1.0

Per Share Data (`)

EPS (Basic)

2.8

2.7

3.5

3.8

EPS (fully diluted)

2.8

2.7

3.5

3.8

Cash EPS

5.2

4.9

6.4

6.1

DPS

-

-

-

-

Book Value

20.2

22.8

26.3

30.1

Returns (%)

ROA

2.99

2.60

3.53

3.98

Angel ROIC (Pre tax)

16.8

14.7

14.5

15.7

ROE

14.1

11.7

13.2

12.5

Turnover ratios (x)

Asset Turnover

42.5

42.1

38.5

35.8

Inventory / Sales (days)

247

294

253

240

Receivables (days)

125

135

144

140

Payables (days)

192

249

162

154

Working capital cycle (ex-cash) (days)

181

180

235

226

Source: Company, Angel Research

7

Jun

27,

201

K.P.R. Agrochem Limited | IPO Note

Jun 27, 2019

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information..

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information..